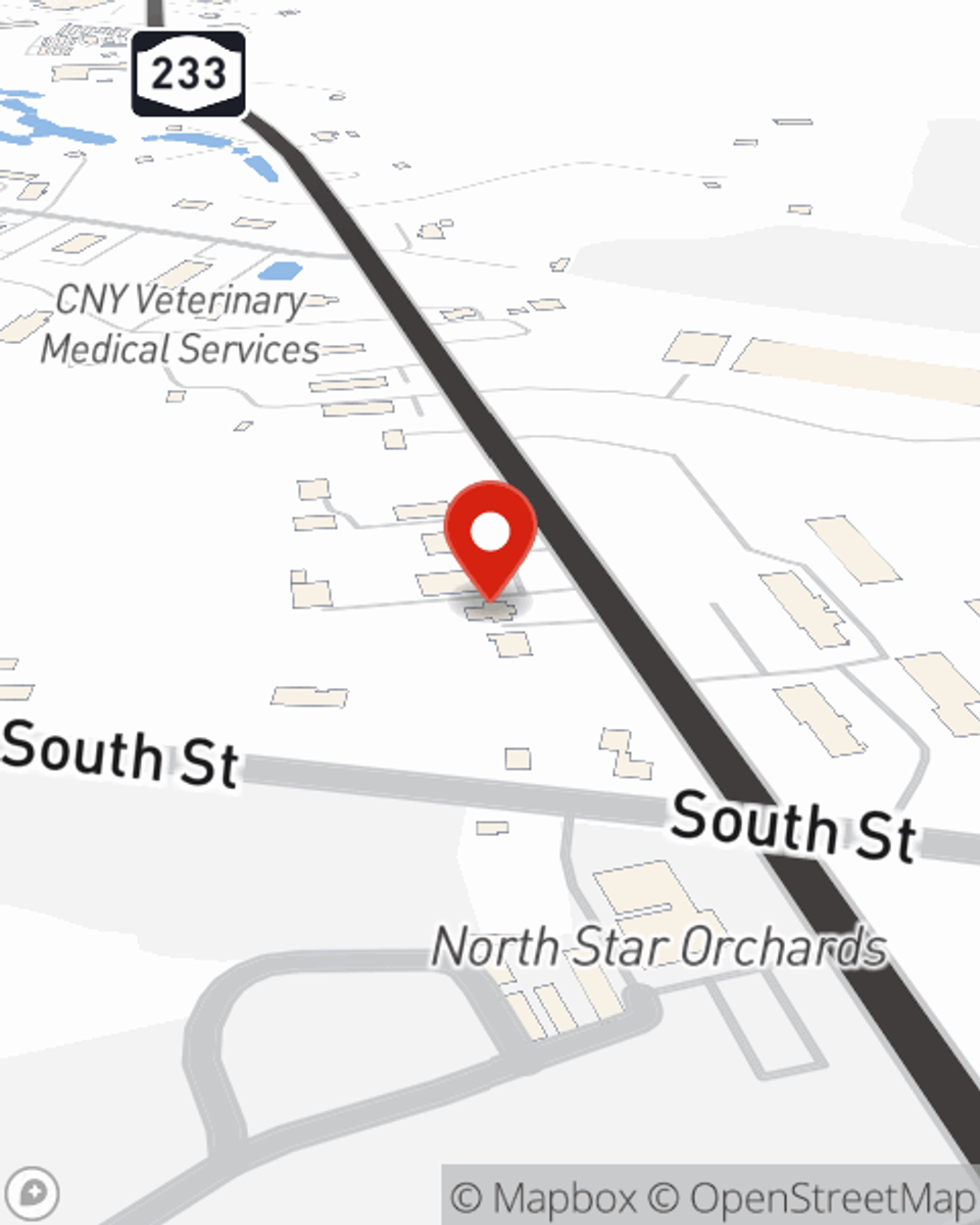

Life Insurance in and around Westmoreland

Coverage for your loved ones' sake

Life happens. Don't wait.

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

It can be a big deal to provide for your partner, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that the people you love can keep paying for your home and/or pay off debts as they grieve your loss.

Coverage for your loved ones' sake

Life happens. Don't wait.

State Farm Can Help You Rest Easy

Fortunately, State Farm offers several policy choices that can be personalized to accommodate the needs of those most important to you and their unique situation. Agent Stuart Brooks has the deep commitment and service you're looking for to help you opt for coverage which can help your loved ones in the wake of loss.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to explore what a company that processes nearly forty thousand claims each day can do for you? Call or email State Farm Agent Stuart Brooks today.

Have More Questions About Life Insurance?

Call Stuart at (315) 381-3375 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.

Stuart Brooks

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.